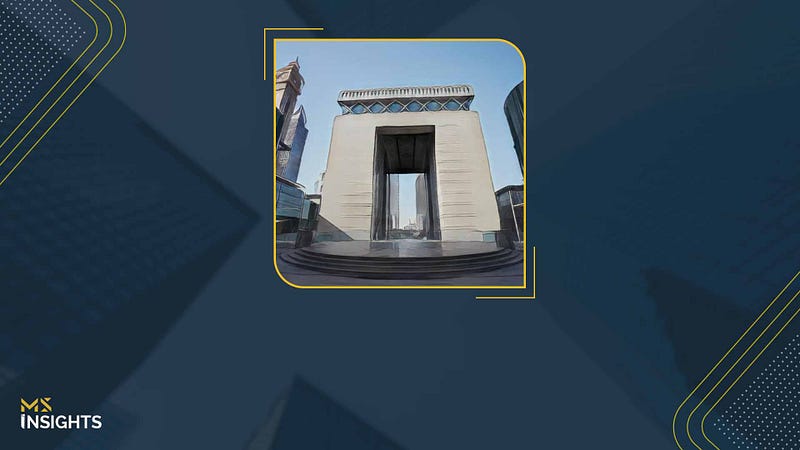

Is DIFC Only for Big Corporations? Think Again: Explore Cost-Effective SPV Formation in DIFC

For years, DIFC has been synonymous with global financial giants, multinational firms, and high-stakes investments. With its reputation as a premier financial hub, many assume that setting up a business here comes with a premium price tag, one that only large corporations can afford.

A world-class financial center with top-tier regulations, tax efficiencies, and a business-friendly environment surely requires a significant capital outlay, right? This perception often leads businesses to explore alternative jurisdictions, missing out on the unique benefits that DIFC has to offer.

But the reality is different. SPV formation in DIFC, also known as Prescribed Company setup, offers a cost-effective and strategic way to establish a presence in one of the world’s most prestigious financial hubs — without breaking the bank.

Why Should You Consider SPV Setup in DIFC for Asset Protection, Investment, and Growth?

SPV setup in DIFC provides a flexible and affordable business structure, making it a smart option for startups, SMEs, and multinationals alike. Unlike traditional entities, DIFC SPVs benefit from key regulatory exemptions — there’s no mandatory business activity requirement in DIFC, no physical office space needed, and simplified financial reporting. This drastically reduces operational complexity and ongoing costs.

These structures are widely used for holding investments, protecting assets, structured financing, and even crowdfunding. The legal framework ensures high standards of compliance while remaining business-friendly. DIFC Prescribed Companies involved in structured financing or crowdfunding enjoy even more exemptions, including relaxed shareholder limits and audit waivers for eligible entities.

Affordable DIFC SPV Formation Costs

DIFC makes SPV formation straightforward and affordable with transparent, low-cost incorporation fees:

- Application Fee: $100

- Annual License Fee: $1,000

With these minimal costs, SPV setup in DIFC becomes one of the most attractive options for businesses establishing holding companies or investment vehicles in the region.

Ongoing DIFC SPV Costs and Flexibility

Once your SPV in DIFC is set up, maintaining it remains affordable:

- Annual License Renewal: $1,000

- Confirmation Statement Filing: $300

- Transfer or Continuation Application: $1,000

- Data Protection Notification (for non-financial entities): $750

- Entity Name/Trade Name Change: $800

These manageable fees ensure that businesses can remain compliant and agile without excessive overheads.

DIFC SPV Setup: A Strategic Move for Future-Focused Businesses

Whether you’re a family business planning succession, a fund structuring cross-border investments, or a tech startup exploring financing options, SPV setup in DIFC offers a smart, scalable solution.

With its seamless digital processes, automated compliance, and access to a globally trusted financial ecosystem, DIFC is redefining accessibility for all business sizes — not just the big players.

Partner with MS, and let our experts handle your DIFC SPV formation from start to finish.

Comments

Post a Comment